The strain the Coronavirus pandemic put on the economy is undeniable. In spite of this, since the second half of 2020, stock markets have reached record highs. As of June, 10, 2021 the Dow Jones closed at an astonishing 34,466.24 points with the S&P 500 reaching an intraday high of 4,239.8 points. This seemingly unfathomable economic bounce back has one word on every investor, economist and citizen’s mind: Inflation.

Overview

Inflation is defined as an increase in cost of goods and services and a downfall in the purchasing power of money. The Federal Reserve has long stood by a standard of maximum inflation around 2%. This simply means that the Federal Reserve aims to account for long-term inflation by containing it at or below 2%, so that in the case of economic distress they can react accordingly. However, in an April statement Federal Reserve chairman Jerome Powell allowed for inflation to run above 2% in the interim. While the stock market has continued to operate at historically high levels, fears of inflation spiraling out of control have entered the minds of millions of Americans.

Current Trends

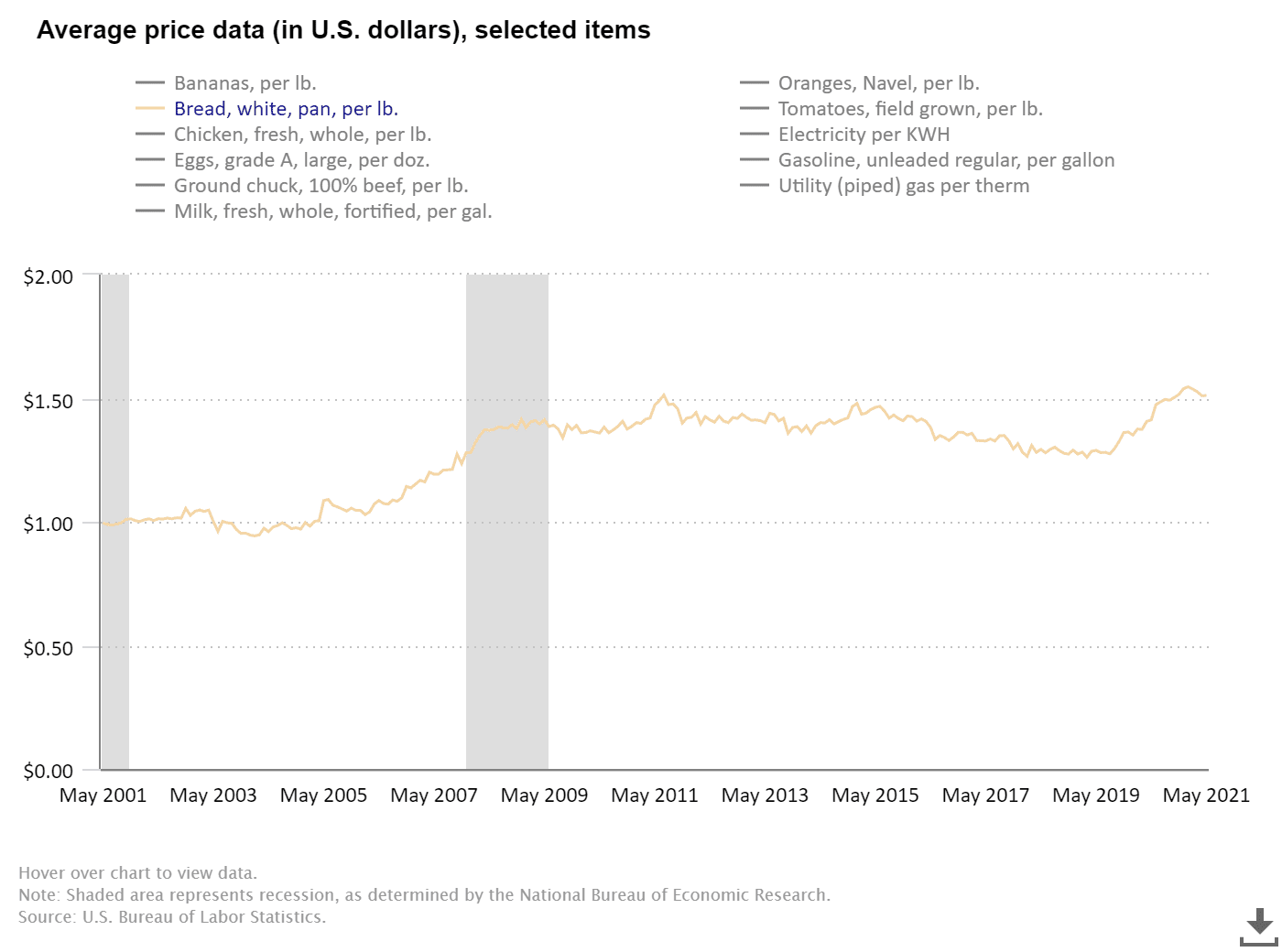

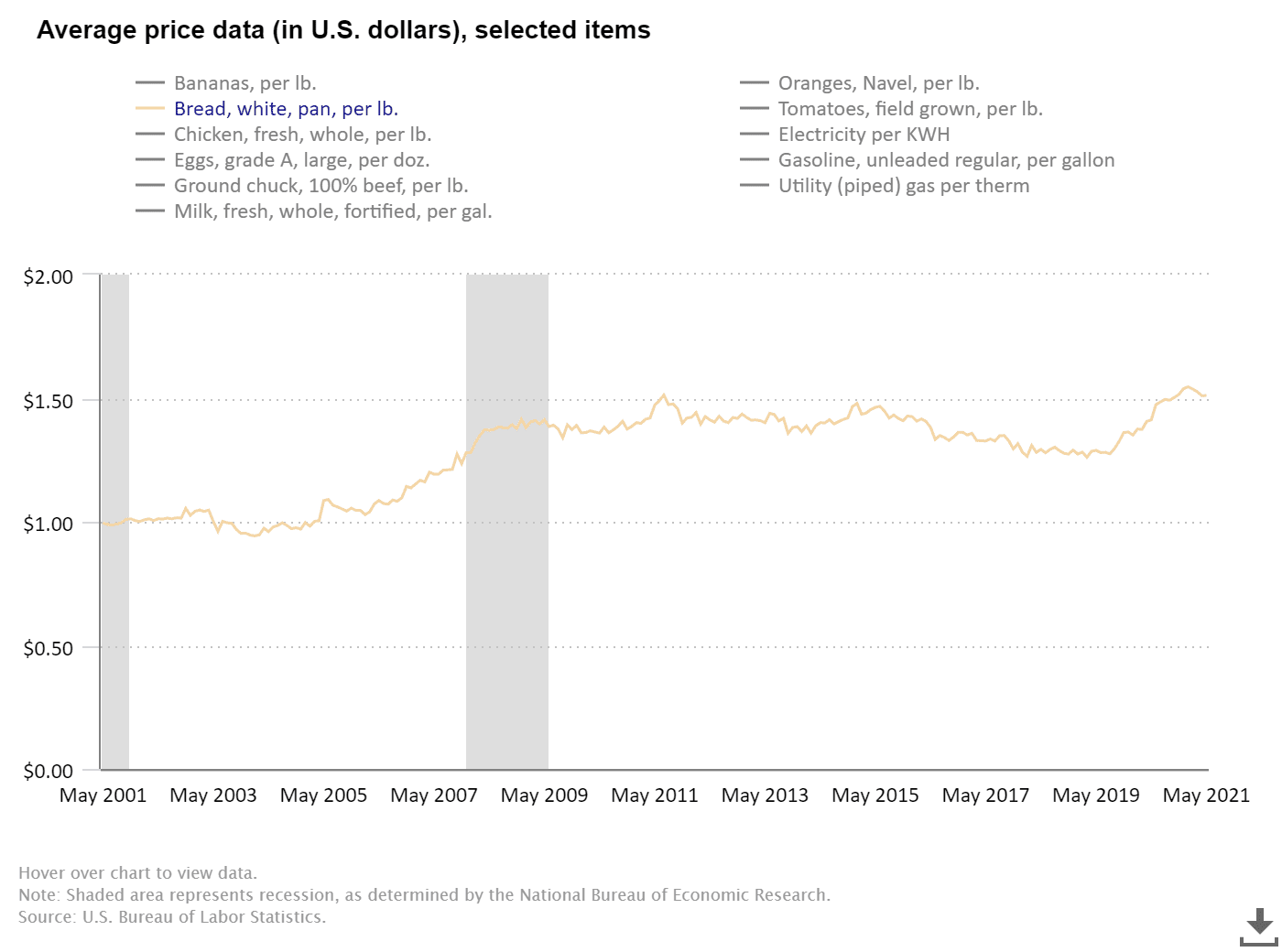

Inflation is impacting American lives in more ways than one. The Consumer Price Index, CPI, is a main gauge of inflation and is up to an astonishing 5%. Not everyone is an economist. What does this mean for the average Joe? The graph below, provided by the U.S. Bureau of Labor Statistics, showcases the fluctuation of the price of bread in the last twenty years.

As we can see, white bread at the beginning of the Coronavirus Pandemic (March, 2020) was an average price of $1.37 per pound. Current data shows that price has since risen to $1.51 per pound in May, 2021. This rise equates to 10.21%, far above the goal of 2% inflation. Similar increases in the price of additional basic food items and other necessities such as transportation and furniture has economists signaling the red flags of inflation.

Economists identified a surge in the price of commodities as one factor in this inflation. Specifically, corn is up nearly 50% from 2020. This may not seem significant to most people as corn is typically just a side on your dinner plate, but a large percentage of the products we eat come from the grain. Kitchen staples such as dairy, meat, and eggs are all connected to the grain, as the main ingredient in 96% of animal feed is corn. Various other foods have some form of corn syrup, corn meal or some derivative of the commodity which is leading to increased prices at the grocery store. In an interview with the WSJ, General Mills Chief Executive Jeff Harmening stated, “The inflation pressure we’re seeing is significant – it’s probably higher than we’ve seen in the last decade”. This cause for concern is already being seen at grocery stores across the country and the trend will likely continue throughout the summer.

Low labor participation due to the loss of jobs during the pandemic has also impacted inflation. As the economy reopens workforce positions remain unfilled due to government support of workers through increased unemployment benefits and various stimulus payments. With industries searching for workers, some are offering higher pay for low-skill jobs to lure people back into the labor force. In fact, mega corporations like McDonald’s are offering $50 just to fill out an application at some locations! This phenomenon is often referred to in economic circles as a “wage/price spiral” and was a key factor in the historic inflation rates we saw in the late 1970s. Amidst all this financial doom and gloom, how can you stay ahead of the curve?

How Can I Prepare?

In order to protect yourself from inflation, it is important to safeguard your assets from losing your hard earned dollars. Financial expert Roger Cowen states, “Inflation is a beast that eats away at your money! Stay away from long-term Bonds/CDs”. Cowen isn’t the only financial expert urging people to prepare. Savant Wealth also recommends checking out value stocks and highly rated short-term bonds. Value stocks are likely to be less reliant on future rapid earnings growth compared to high growth stocks like Tesla, which has seen a 20% stock price dip in 2021. Highly rated short term bonds are often less sensitive to interest rate changes, and may provide a good alternative to other investments in a rising interest rate environment.

No one truly knows what is going to happen in the coming weeks, months or years in regard to inflation. Meeting with a trusted financial advisor can help you diversify your portfolio and protect you from possible rising inflation rates. Cowen Tax Advisory Group has 42+ years of expertise and can help answer any questions or concerns you may have regarding the current financial climate. Call our West Hartford, CT office today at 860-676-1100 to achieve some financial peace of mind.

Connor Rosenberger

connorctag@gmail.com

As Cowen Tax Advisory Group’s Digital Content Marketing Specialist, Connor provides in-house copywriting and manages the company’s electronic records system, email marketing, and blog.