Do you need a tax preparer? If you’re used to doing your taxes on your own or with a DIY software service, it can be hard to tell. Here are a few reasons you might want to enlist the help of a tax professional.

1. You have a complex return

Whether you’re retired, own rental property, or maintain multiple investments, your complex return is probably better off in the hands of a professional.

Margin of Error

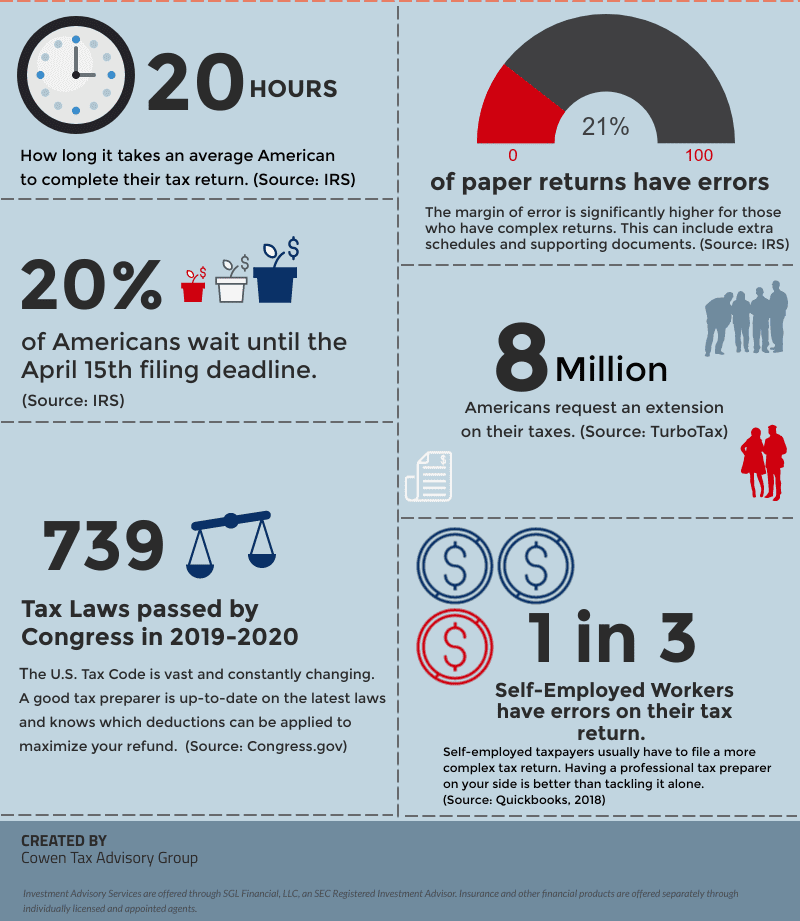

Extra schedules and supporting documents mean more opportunities for errors and miscalculations. For example, a 2015 IRS internal review discovered that 40% of returns surveyed miscalculated or otherwise misreported a retirement account payout. A qualified tax professional knows how to complete these forms and can catch misprints on original tax documents that you might miss.

Audit Magnet

Returns with Schedule C’s, rental property losses, and higher than average deductions or income receive extra attention from the IRS. Experienced tax preparers provide adequate justification for claimed deductions and avoid strategies that are common red flags to IRS agents. If your tax return is complicated, working with an expert can prevent an audit.

Bigger Refund

The more complex your return, the more opportunities you have to claim deductions and credits. Tax preparers know how to work the tax code to your benefit, whether that means maximizing your refund or minimizing your tax bill. A professional can spot opportunities that most do-it-yourselfers pass over.

Better Tech

Turbo Tax might be a good choice for your neighbor and his W2, but if your return is complex, free tax preparation software may not meet your needs. CPAs and enrolled agents have access to more sophisticated software that is designed to handle more sophisticated returns.

2. You prefer a human touch

Extroverts and low-techies agree: there’s nothing like human interaction. Not everyone is comfortable handing over their tax documents to an anonymous computer program, and that’s just fine. Working with a tax professional combines the accuracy of high-quality tax preparation with the warmth of good customer service.

3. You have questions

“What is AMT?”

“How does the latest tax legislation impact my return?”

“Do my new dentures qualify for the medical expense deduction?”

If you prepare your own return, you’ll have to answer your own questions or pay extra to consult with someone through a DIY software program. With a tax preparer, the answers are included, free of charge.

4. You’re short on time

Too busy to do your taxes? Have someone else do them for you.

5. You’re self-employed

A Quickbooks survey found that 36% of self-employed Americans have been audited by the IRS. This isn’t surprising, considering that self-employed taxpayers have to deal with the self-employment tax and may even have to file an additional return for their business. Unless you work as a freelance accountant, it’s best to consult with a professional instead of trying to tackle your self-employed return alone.

6. You bought or sold your home

Real estate taxes, mortgage interest, private mortgage insurance, owner’s title insurance, survey fees: the list of home-related deductions goes on. The tax implications of buying or selling a house are extensive. A tax preparer will make sure the sale is reported correctly on your return and help you take advantage of all available credits and deductions.

7. You want a better refund

The U.S. Tax Code is vast and constantly changing. A good tax preparer is up-to-date on the latest laws and knows about under-used deductions that can help you get the most out of your refund. In most cases, adding even one deduction to your tax return is enough to off-set the cost of hiring a preparer.

8. You want tax planning

Tax preparers can help you save on your next tax return by providing tax planning advice. If you have investments, tax planning can help you harvest tax losses, reduce capital gains, and defer taxes on dividends and interest so you can maximize your returns.

Looking for someone to prepare your taxes? Cowen Tax Advisory Group of West Hartford offers professional tax preparation and planning at unbeatable prices. Request your appointment today.

Sara McKinney

saractag@gmail.com

As Cowen Tax Advisory Group’s Digital Content Marketing Specialist, Sara provides in-house copywriting and manages the company’s electronic records system, email marketing, and blog.